The Pvm Accounting PDFs

Table of ContentsThe Ultimate Guide To Pvm Accounting5 Easy Facts About Pvm Accounting ShownThe Ultimate Guide To Pvm AccountingPvm Accounting Things To Know Before You BuyThe Buzz on Pvm AccountingThe Basic Principles Of Pvm Accounting Excitement About Pvm Accounting

In terms of a business's total method, the CFO is liable for leading the firm to meet economic objectives. Some of these techniques can involve the firm being obtained or procurements going ahead.

As a service grows, bookkeepers can release up a lot more team for other company obligations. As a building company grows, it will demand the aid of a full-time economic personnel that's managed by a controller or a CFO to handle the firm's funds.

The Buzz on Pvm Accounting

While huge businesses may have permanent monetary support groups, small-to-mid-sized businesses can work with part-time bookkeepers, accounting professionals, or monetary experts as required. Was this post valuable?

As the building and construction sector remains to thrive, organizations in this industry should preserve strong financial monitoring. Reliable bookkeeping practices can make a substantial distinction in the success and development of building and construction companies. Let's discover 5 important accountancy techniques customized specifically for the construction industry. By executing these methods, building services can boost their economic security, improve operations, and make notified decisions - construction taxes.

Comprehensive estimates and budgets are the backbone of construction task administration. They help guide the project in the direction of prompt and successful conclusion while safeguarding the passions of all stakeholders included.

The Only Guide for Pvm Accounting

A precise evaluation of products needed for a task will assist ensure the required products are purchased in a prompt way and in the ideal amount. A mistake below can cause wastefulness or hold-ups due to material shortage. For the majority of building jobs, tools is required, whether it is purchased or rented.

Appropriate devices estimate will certainly aid make certain the right equipment is offered at the ideal time, conserving time and cash. Do not neglect to account for overhead expenses when estimating project costs. Direct overhead expenses specify to a task and may include momentary leasings, energies, fence, and water materials. Indirect overhead costs are everyday expenses of running your service, such as lease, administrative salaries, energies, taxes, depreciation, and marketing.

Another variable that plays into whether a job succeeds is an exact estimate of when the task will be completed and the relevant timeline. This price quote assists guarantee that a project can be ended up within the designated time and resources. Without it, a task may run out of funds prior to conclusion, causing potential job interruptions or abandonment.

The Of Pvm Accounting

Exact job costing can aid you do the following: Understand the earnings (or do not have thereof) of each project. As task setting you back breaks down each input right into a project, you can track success independently. Contrast actual expenses to price quotes. Managing and evaluating price quotes allows you to much better price work in the future.

By identifying these items while the project is being finished, you avoid surprises at the end of the task and can address (and hopefully stay clear of) them in future tasks. A WIP routine can be completed monthly, quarterly, semi-annually, or yearly, and includes project information such as agreement value, sets you back incurred to date, complete estimated costs, and complete task invoicings.

Examine This Report on Pvm Accounting

Budgeting and Projecting Devices Advanced software application offers budgeting and projecting capabilities, enabling construction business to plan future tasks much more properly and handle their finances proactively. Document Monitoring Building projects involve a lot of documentation.

Improved Vendor and Subcontractor Monitoring The software can track and handle payments to suppliers and subcontractors, making sure prompt payments and preserving excellent relationships. Tax Prep Work and Filing Accountancy software program can assist in tax prep work and filing, making sure that all pertinent financial activities are properly reported and tax obligations are filed on schedule.

The Definitive Guide to Pvm Accounting

Our client is an expanding advancement and building and construction firm with head office in Denver, Colorado. With multiple energetic building jobs in Colorado, we are seeking an Accountancy Assistant to join our team. We are looking for a full-time Accountancy Aide that will certainly be in charge of offering practical assistance to the Controller.

Receive and examine everyday billings, subcontracts, change orders, purchase orders, inspect demands, and/or various other related documentation for efficiency and conformity with economic policies, treatments, budget, and contractual demands. Exact handling of accounts payable. Enter invoices, approved draws, order, etc. Update monthly analysis and prepares budget plan fad records for building jobs.

Some Known Questions About Pvm Accounting.

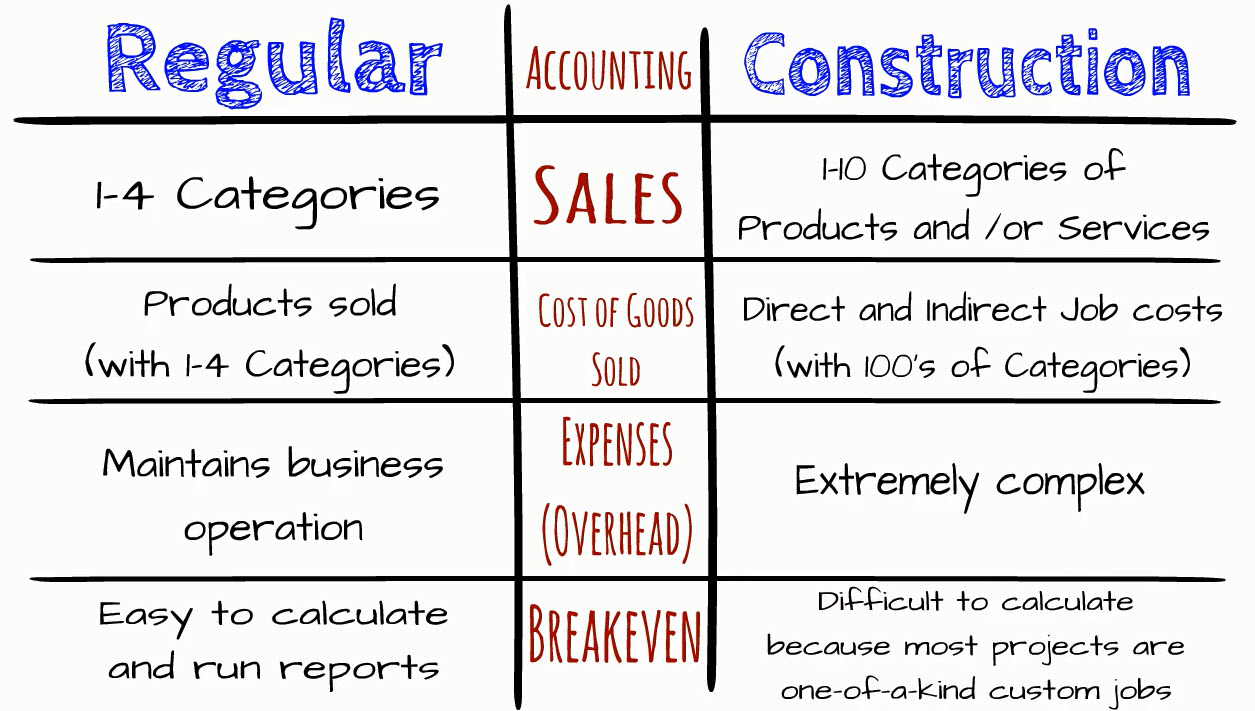

In this overview, we'll dive right into various elements of building accounting, its significance, the requirement devices made use of around, and its duty in building and construction projects - https://pvmaccount1ng.edublogs.org/2024/05/22/mastering-construction-accounting-your-complete-guide/. From monetary control and expense estimating to capital monitoring, discover how bookkeeping can profit building jobs of all ranges. Building and construction audit describes the specialized system and processes used to track financial details and make tactical decisions for building and construction companies